Compound interest formula with annual contributions

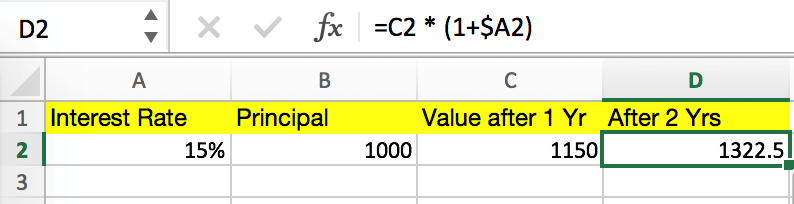

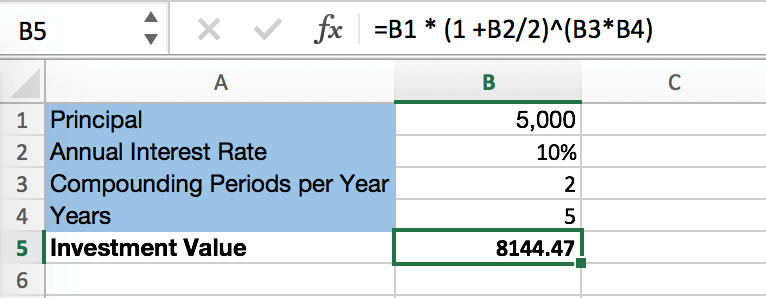

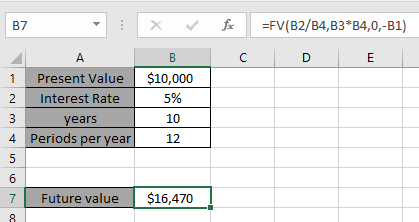

It can be handy to visualize compound interest by creating a simple model in Excel that shows the growth of your investment. A the future value or FV of the investmentloan including interest.

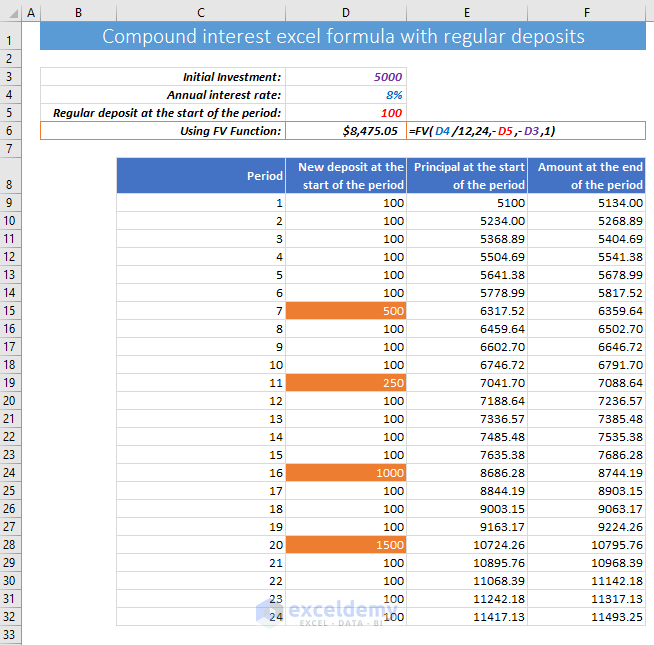

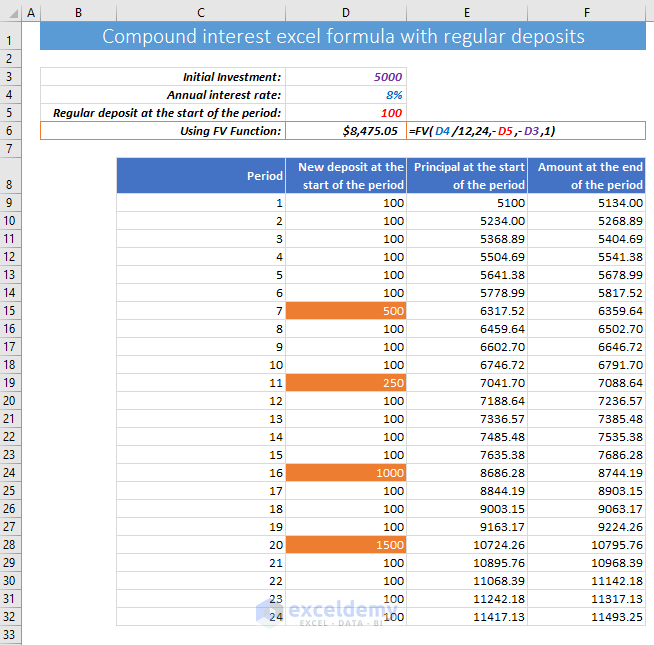

Compound Interest Excel Formula With Regular Deposits Exceldemy

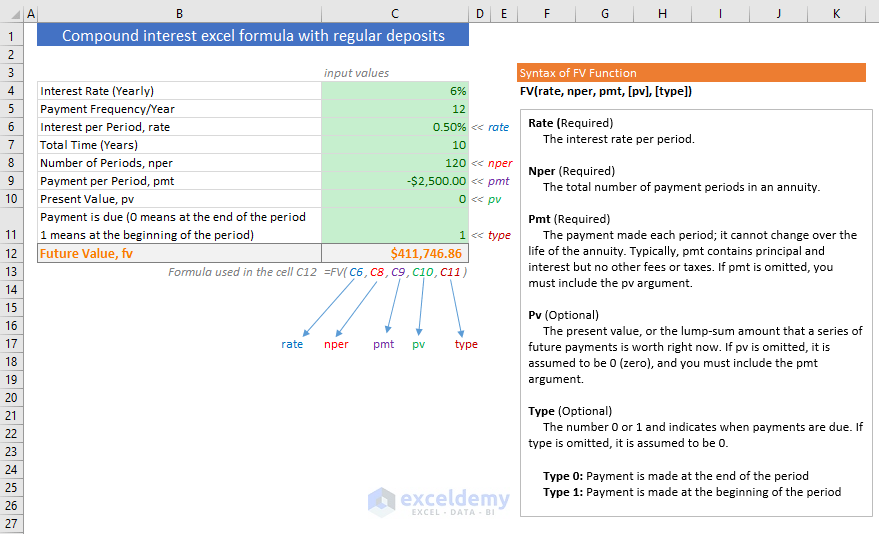

The interest can be compounded annually semiannually quarterly monthly or daily.

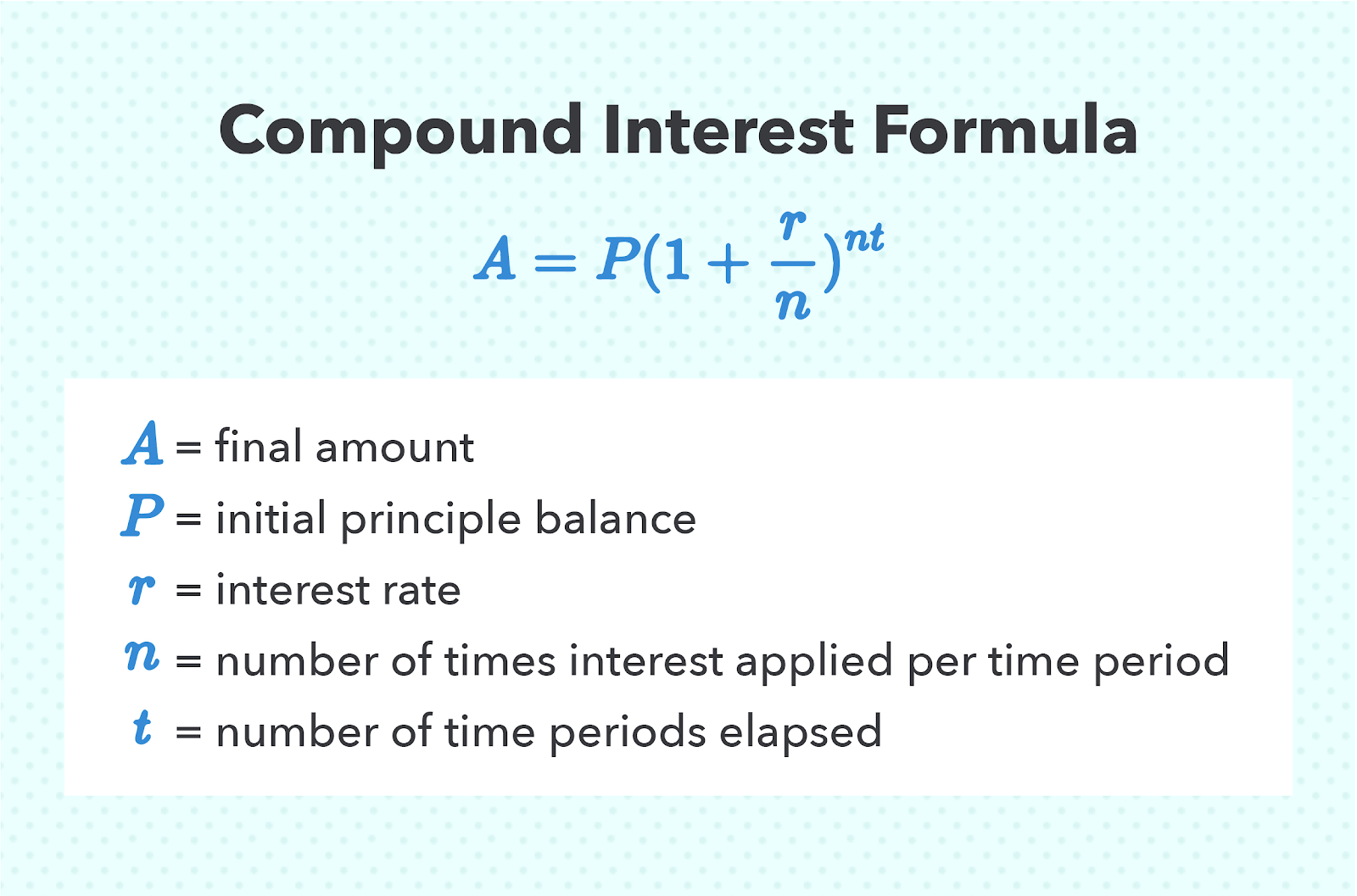

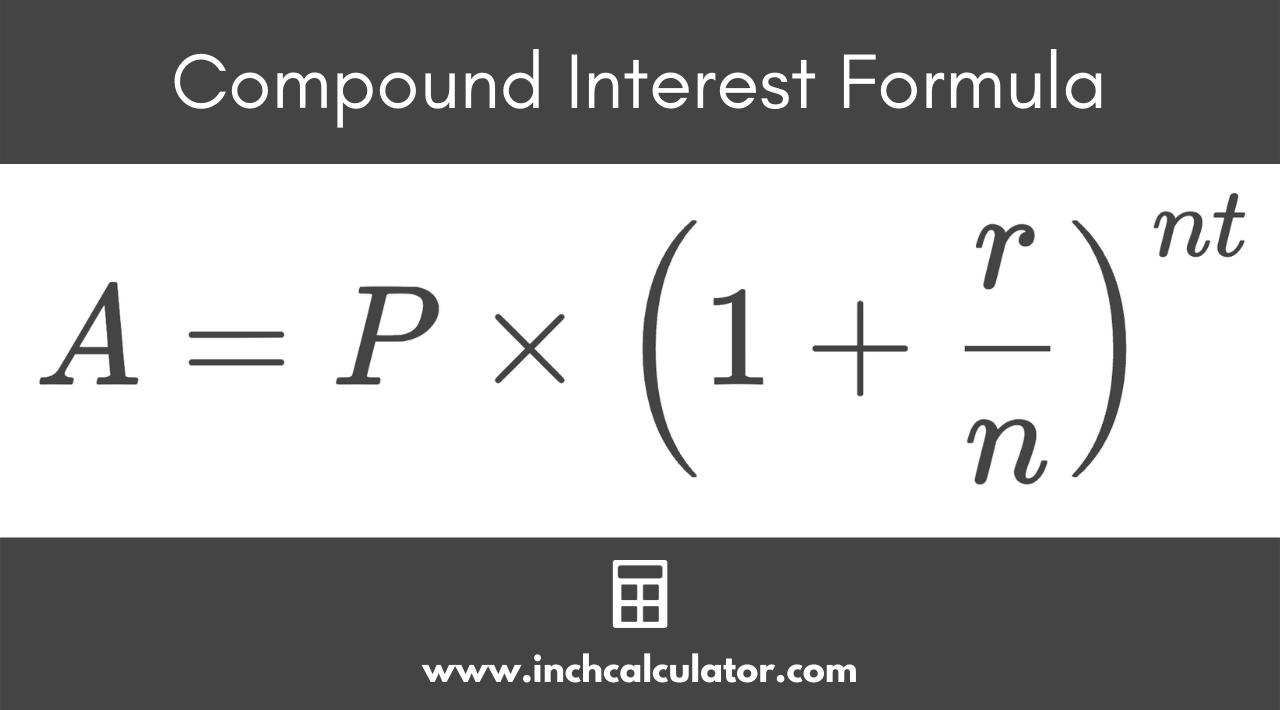

. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan. In finance and economics interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum that is the amount borrowed at a particular rate. The formula for compound interest is A P1 rnnt where P is the principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods.

Years at a given interest. Mutual funds dont earn a fixed interest rate. Historically contributions to DAFs at Single-Issue Charities have been less predictable than the other two types of DAF sponsors with the highest rate of increase at 351 percent in.

How to Calculate Compound Interest. The compound annual growth rate from 2016 to 2020 was 48 percent. You can find many of these calculators online.

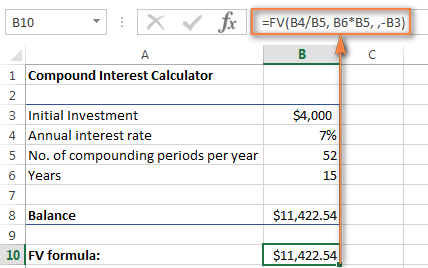

Compound interest and the rule of 72. The formula to calculate your compound interest is. Plus you can also program a daily compound interest calculator Excel formula for offline use.

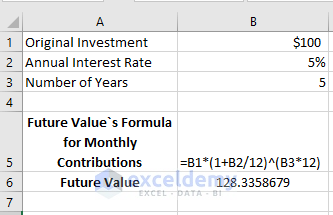

Struggling with the formulas. Annual cost exceeded non-interest income in 2010 and is projected to continue to be larger throughout the remainder of the 75-year valuation period. Making routine monthly contributions to your investing accounts will be essential to build wealth.

Assuming a 7 annual interest rate after the first year your account would be worth 10700. R the annual interest rate expressed in decimal form decimal 100. Your estimated annual interest rate.

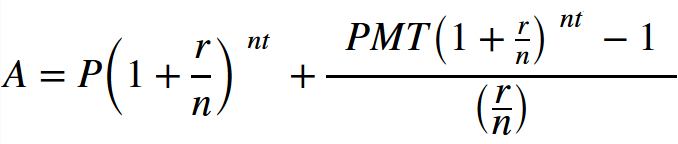

A P1 rnnt. R is the interest rate typically this is an annual rate n is the number of times interest compounds during each time period. Finally we change from annual contributions and compounding to monthly.

It is distinct from a fee which the borrower may pay the lender or some third party. Start by opening a document and labeling the top cell in columns A B and C Year Value and Interest Earned respectively. The rule of 72 helps you.

A third makes 45 years of contributions. See how much you can save in 5 10 15 25 etc. Interest rate variance range.

Or the advanced formula with annual additions as well as a calculator for periodic and continuous. Nevertheless from 2010 through 2022 total trust fund income including interest income is more than is necessary to cover costs so trust fund assets will continue to grow during that time. T is the number of time periods.

When youre investing to save for retirement you should put your money in mutual funds. P is the initial principal balance. In this last scenario the investor.

A is the ending balance including the compounded interest. Compound Annual Growth Rate CAGR Compound Annual Growth Rate is an important investment concept thats related to compound interest. Putcall parity is a static replication and thus requires minimal assumptions namely the existence of a forward contractIn the absence of traded forward contracts the forward contract can be replaced indeed itself replicated by the ability to buy the underlying asset and finance this by borrowing for fixed term eg borrowing bonds or conversely to.

The formula for calculating compound interest accumulation on a given account balance is. Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons. Its a way to measure the growth rate of your investments over time.

This is how much total interest youve earned. N the number compounding periods per year n 1 for annually n 12 for monthly etc. Applying the Formula for Compound Interest.

Well use basic math to demonstrate compound interest first. This is a compound interest calculator savers can use to get an idea of how. With simple interest the balance on that bond would have been 23250 on the maturity date.

Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest. Include additions contributions to the initial deposit or investment for a more detailed calculation. If you want to roughly calculate compound interest on a savings figure without using a calculator you can use a formula called the rule of 72.

The genetic code is a set of three-nucleotide sets called codons and each three-nucleotide combination designates an amino acid for example AUG. Determine how much your money can grow using the power of compound interest. Create an Excel document to compute compound interest.

Enter the years 0-5 in cells A2. Compound Daily Interest Calculator. R is also known as rate of return.

The power of compound interest means you earn interest on interest. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. It is also distinct from dividend which is paid by a company to its.

The more times the interest is compounded within the year the higher the effective annual interest rate will be. It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. In other words this is the.

If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. If this gives you scary high school flashbacks skip to the next section for the spreadsheet version. Jim William Glanz says.

The Compound Interest Formula. All funds compound annually at 8. Range of interest rates above and below the rate set above that you desire to see results for.

Compound interest helps your investments and savings grow faster. Each protein has its own unique amino acid sequence that is specified by the nucleotide sequence of the gene encoding this protein. P is the principal P r is the annual rate of interest and n is the number of times the interest is compounded per year.

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. February 4 2019 at 941 pm. The other parameters stay the same.

Use our calculator to estimate how much your money can grow with the aid of compound interest. Proteins are assembled from amino acids using information encoded in genes. Compound interest or interest on interest is calculated using the compound interest formula.

Another way to make an annual compound interest formula is to calculate the earned interest for each year and then add it to the initial deposit. The compound interest formula is. Know the formula for calculating the effect of compound interest.

Adjust the lump sum payment regular contribution figures term and annual interest rate. Its a combination of your own contributions plus whatever interest youve earned. The Principle of Compound Interest.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. While this may not seem like much once we increase the variable of the years of the 20000 compound interest investment we would see a balance of 98977 in 50 years compared to just 52500 with simple interest. P the principal investment amount the initial deposit or loan amount also known as present value or PV.

Compound Interest Excel Formula With Regular Deposits Exceldemy

How To Calculate Compound Interest Quora

Compound Interest Formula And Calculator For Excel

What Is Compound Interest A Guide To Making It Work For You Not Against You Gobankingrates

Capitalize On Uninterrupted Compound Interest Wealth Nation

Compound Interest With Monthly Contributions Calculator Formula

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Excel Formula With Regular Deposits Exceldemy

How To Work Out Compound Interest On Savings 14 Steps

Compound Interest Formula In Excel And Google Sheets Automate Excel

How To Calculate Compound Interest In Google Sheets 3 Examples Statology

Compound Interest Formula And Calculator For Excel

How To Use Compound Interest Formula In Excel Exceldemy

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Calculator Inch Calculator

How To Use Compound Interest Formula In Excel Exceldemy

How To Use Compound Interest Function In Excel